Business Insurance in and around Greenwood

Calling all small business owners of Greenwood!

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like a surety or fidelity bond, errors and omissions liability and extra liability coverage, you can feel secure knowing that your small business is properly protected.

Calling all small business owners of Greenwood!

Almost 100 years of helping small businesses

Cover Your Business Assets

At State Farm, apply for the great coverage you may need for your business, whether it's a barber shop, a veterinarian or an insurance agency. Agent Hart Kittle is also a business owner and understands what you need. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage takes the cake.

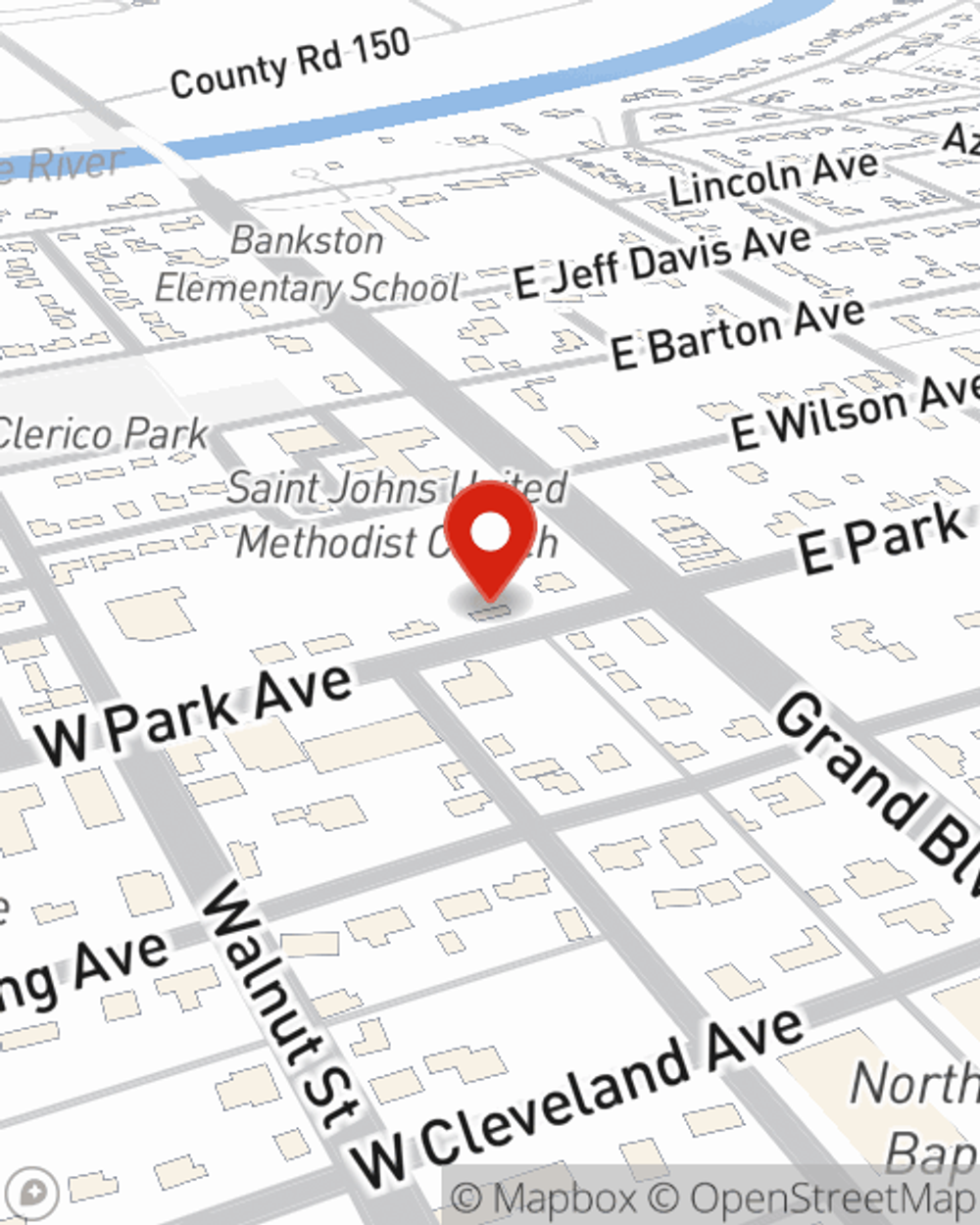

Get right down to business by visiting agent Hart Kittle's team to review your options.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

Hart Kittle

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.